-

Sales & Distribution

Sales and Distribution

Interdependence of Demand and Supply

Components of Sales — Width & Depth

Measures of Distribution (Width)

Sales and Distribution Priorities

Distribution Network — Basics

Relationship between Sales and Distribution

Right Channels, Right Chains

Right Assortment

Managing Assortment

Battle of Shelf Space

Measures of Assortment and Sales Velocity

Number of Items Stocked

Assortment Analysis

Sales per Point of Weighted Distribution

Share in Handlers

Average Sales per Store

Rate of Sales

Rate of Sales/Gross Profit

Portfolio Analysis

Fragmentation Analysis

Securing Retailer Support

Managing Stock in Trade

Allocation of Shelf Space

Cost of Stockouts

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Sales & Distribution

Sales and Distribution

Interdependence of Demand and Supply

Components of Sales — Width & Depth

Measures of Distribution (Width)

Sales and Distribution Priorities

Distribution Network — Basics

Relationship between Sales and Distribution

Right Channels, Right Chains

Right Assortment

Managing Assortment

Battle of Shelf Space

Measures of Assortment and Sales Velocity

Number of Items Stocked

Assortment Analysis

Sales per Point of Weighted Distribution

Share in Handlers

Average Sales per Store

Rate of Sales

Rate of Sales/Gross Profit

Portfolio Analysis

Fragmentation Analysis

Securing Retailer Support

Managing Stock in Trade

Allocation of Shelf Space

Cost of Stockouts

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Sales and Distribution — Right Channels, Right Chains

Your products need to be where your consumers usually go to buy them. Targeting the right retailers with the right products requires knowledge of channel and chain characteristics, as well as an understanding of retail trends. The key considerations are sales density, shopper profile and store positioning.

Sales Density

Various classes of goods such as FMCG, durables, clothing, petroleum, fast food, and more, are typically sold through different types of outlets. Additionally, within the same class of goods, the significance of various channels can vary based on different product categories, market segments, or specific brands.

Taking FMCG as an example, different products such as cheeses, cakes, cigarettes, colas, and cleansers are typically sold through distinct types of stores. This variation in channel selection is influenced by factors such as consumer preferences, distribution strategies, target markets, and competitive dynamics within the industry. By tailoring the distribution channels to the specific characteristics of the product, brands can optimize their market reach and maximize sales potential.

In general, the sales force should target those channels and chains with high sales density for their product segments and variants. Usually this is self-evident at the category level. However, sales personnel need to keep track of trends and changes in shopping behaviour so that they know what segments, variants, and pack sizes to prioritize at which stores. A brand’s market share is severely affected if the distribution of variants, pack types and pack sizes is not aligned with shoppers’ preferences.

For instance, the sales of a major sanitary napkin brand were constrained because it was not available at Watsons, at that time a fast-growing personal care chain in parts of Asia. Once the importance of the chain was revealed, the manufacturer was prepared to accept the relatively high listing fees that the chain commanded. In addition to sales, the brand’s consumer profile also improved — young women tended to shop more at Watsons.

In another instance, a brand of batteries experienced low market share in supermarkets because shoppers prefer to purchase large pack sizes in supermarkets, and the brand’s large packs were not listed in those outlets.

In yet another instance, a breakfast cereals brand experienced sluggish sales because it was not available in small packs. In the Asian market that the brand had entered, people who are not accustomed to consuming breakfast cereals preferred to try small packs before they started buying the bigger packs.

Shopper Profile and Store Positioning

Brands target consumers. Retailers target shoppers. Together they build marketplace equity.

From the perspective of both manufacturers and retailers, it is important to ensure that the presence and visibility of brands is heightened in outlets that cater to shoppers whose profile aligns with the target consumer profile of the brands. This serves as a fundamental basis for prioritizing distribution, in-store activities, and communication within the store.

Adjacencies too are important. Manufacturers need to be mindful of the retailer’s role and positioning, because the mere presence of a brand in a chain colours consumers’ perception of the brand.

Take for instance high end department stores and mainstream personal care chains. While these are the two most important channels for facial care products, they diverge in nearly every aspect of their retailing mix, and target contrasting shopper segments.

Even within a channel such as department stores or supermarkets, positioning can vary significantly. Some department stores primarily offer premium designer labels, while others concentrate on masstige and mid-range products, and there are those that specialize in affordable, popular items at low prices.

Mindful of the way the channels and chains are positioned, manufacturers strategically prioritize different brands at different outlets. For instance, L’Oréal’s Plénitude and Garnier ranges of facial care products are usually not found in the same outlets. Plénitude, a relatively premium product, is distributed in upmarket department stores, whereas Garnier is available in mainstream personal care chains.

Previous Next

Use the Search Bar to find content on MarketingMind.

Online Apps to train Retailers

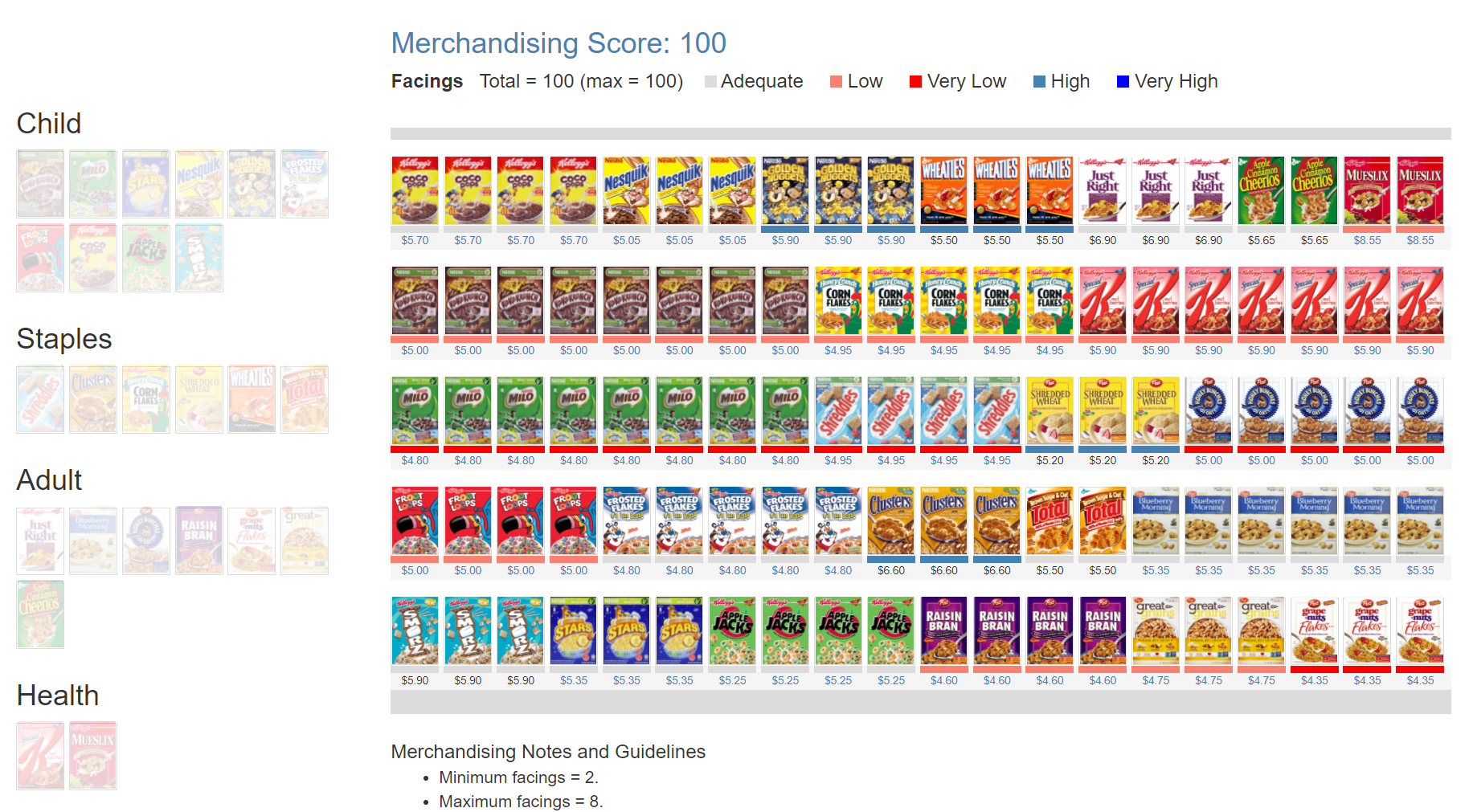

The Plannogrammer is an experiential learning facility for category managers, trade marketers, and retailers in consumer markets. Ideally suited for hybrid learning programmes, Plannogrammer imparts hands-on training in the planning and evaluation of promotions and merchandising.

It supports a collection of simulation and analysis platforms such as Promotions and Space Planner for optimizing space and promotions, Plannogram for populating shelves and merchandising, a Due To Analysis dashboard that decomposes brand sales into the factors driving sales, and a Promotion Evaluator to evaluate the volume, value and profit impact of promotion plans.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.