-

Customer Satisfaction

Retention and Attrition

Evolution of Customer Satisfaction

Customer and Employee Satisfaction

Customer Loyalty

Customer Satisfaction Research

Transaction Survey

Relationship Survey

Drivers — Customer Loyalty

Interpretation & Recommendation

Kano Model

Customer Value

Customers’Purchasing Philosophy

Value-in-Use Analysis

Value Assessment

Customer Value Management

Customer Lifetime Value

- Segmentation

- Qualitative Research

- Quantitative Research

- Customer Satisfaction and Customer Value

- Consumer Panels and Consumer Analytics

- Big Data and Consumer Analytics

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Customer Satisfaction

Retention and Attrition

Evolution of Customer Satisfaction

Customer and Employee Satisfaction

Customer Loyalty

Customer Satisfaction Research

Transaction Survey

Relationship Survey

Drivers — Customer Loyalty

Interpretation & Recommendation

Kano Model

Customer Value

Customers’Purchasing Philosophy

Value-in-Use Analysis

Value Assessment

Customer Value Management

Customer Lifetime Value

- Segmentation

- Qualitative Research

- Quantitative Research

- Customer Satisfaction and Customer Value

- Consumer Panels and Consumer Analytics

- Big Data and Consumer Analytics

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Customer Lifetime Value

Customer Lifetime Value (CLV) measures the profit generated from a customer throughout the business relationship. It can be defined as the monetary value of a customer, based on the present value of the projected future cash flows from the customer.

Take for instance an annual fee-based service. From a customer, such a service would earn:

$$ annual\;fee×average\;gross\;margin×L=margin×L $$Where L is the expected life in years of the customer relationship.

If the annual fee is $100,000, the gross margin is 20% and the relationship is expected to last 3 years, then the total amount earned would be:

$$ $100,000×20\%×3=$20,000×3=$60,000. $$This, however, does not account for the present value of future cash flows.

Present value (PV) is the current value of a future stream of cash flows given a specified rate of return. It accounts for the time value of money, i.e., a dollar today is worth more than a dollar in the future.

If the discount rate is 5%, for the above example:

$$ CLV=$20,000 + \frac{$20,000}{1+0.05}+ \frac{$20,000}{(1+0.05)^2} = 57,188 $$Customer Lifetime Value Models

Typically, CLV calculation are based on three parameters:

- Retention rate (r) is the percentage of customers a business retains over a year. The model assumes the retention rate is constant over the life span of the customer relationship.

- Discount rate (d) is the cost of capital used to discount future revenue from a customer.

- Margin (M) — the contribution margin, i.e., revenue minus variable costs.

If the annual revenue is $100,000, the gross margin is 20%, the retention rate is 90% and the discount rate is 5%, then (Case I):

$$ CLV = M×\frac{1+d}{1+d-r} = 20,000×\frac{1+0.05}{1+0.05-0.9} = $140,000 $$In case revenue is realized at year end, then (Case II):

$$ \boldsymbol{CLV}=M×\left( \frac{r}{1+d}+\left(\frac{r}{1+d}\right)^2+\left(\frac{r}{1+d}\right)^3+⋯\right)\boldsymbol{= M×\frac{r}{1+d-r}} $$ $$ =20,000 × \frac{0.9}{1+0.05-0.9} = $120,000 $$To illustrate the benefit of retaining customers, if the retention rate increased from 90% to 95%, i.e., the churn is reduced from 10% to 5%, then CLV increases to $210,000 (+50%) for Case I and $190,000 (+58%) for Case II.

Where the retention rate varies over time, cohort analysis would be required for computing CLV.

Furthermore, if revenue varies over time, the CLV model will need to be modified to account for growth in revenue.

Importantly customers are heterogenous. They should be segmented according to characteristics such as size, length of relationship, new versus repeat customers, and level of satisfaction (refer Section Customer Loyalty). The revenue, revenue growth/decline rate, variable cost and retention rate would vary significantly across these segments. And the drivers for customer satisfaction (refer Section Drivers of Customer Loyalty and Customer Satisfaction) also vary across segments. Businesses therefore need to analyse CLV and craft business plans at the segment level.

It is also increasingly feasible to construct CLV models for individual customers. This requires estimation of the model parameters for individual customers based on a variety of factors including their past transactions and behaviours (CRM data), loyalty or satisfaction level (customer satisfaction data), and demographic and psychographic profile.

Application of Customer Lifetime Value Models

Knowing how much a new customer is worth indicates the amount businesses can spend to acquire the customer, especially in direct response marketing. When the cost of acquiring the customer is significantly less than the customer’s lifetime value, then the customer is considered profitable and should be pursued.

For existing customers, marketing schemes can be evaluated through sensitivity analysis to optimize their lifetime value. CLV models can be modified to include the incremental marketing costs and the resulting increase in the expected retention rate. A marketing scheme may then be deployed for those customers where it is expected to generate an increase in the CLV. Similarly, the quantum of a marketing initiative may be adjusted to maximize CLV.

Marketing simulators employing CLV models for customers can be used to optimize sales and marketing investments and improve business performance.

CLV models also form the basis for selecting and prioritizing customers for targeted marketing efforts and communication strategies. They empower marketers to optimize the allocation of their limited resources, differentiating their offering for high value long-term customers.

Importantly CLV models are dynamic, not static, and customer segments are porous. Based on their understanding of what drives customer satisfaction, marketers must devote efforts to boost loyalty so that their customers move up the loyalty ladder.

Previous

Use the Search Bar to find content on MarketingMind.

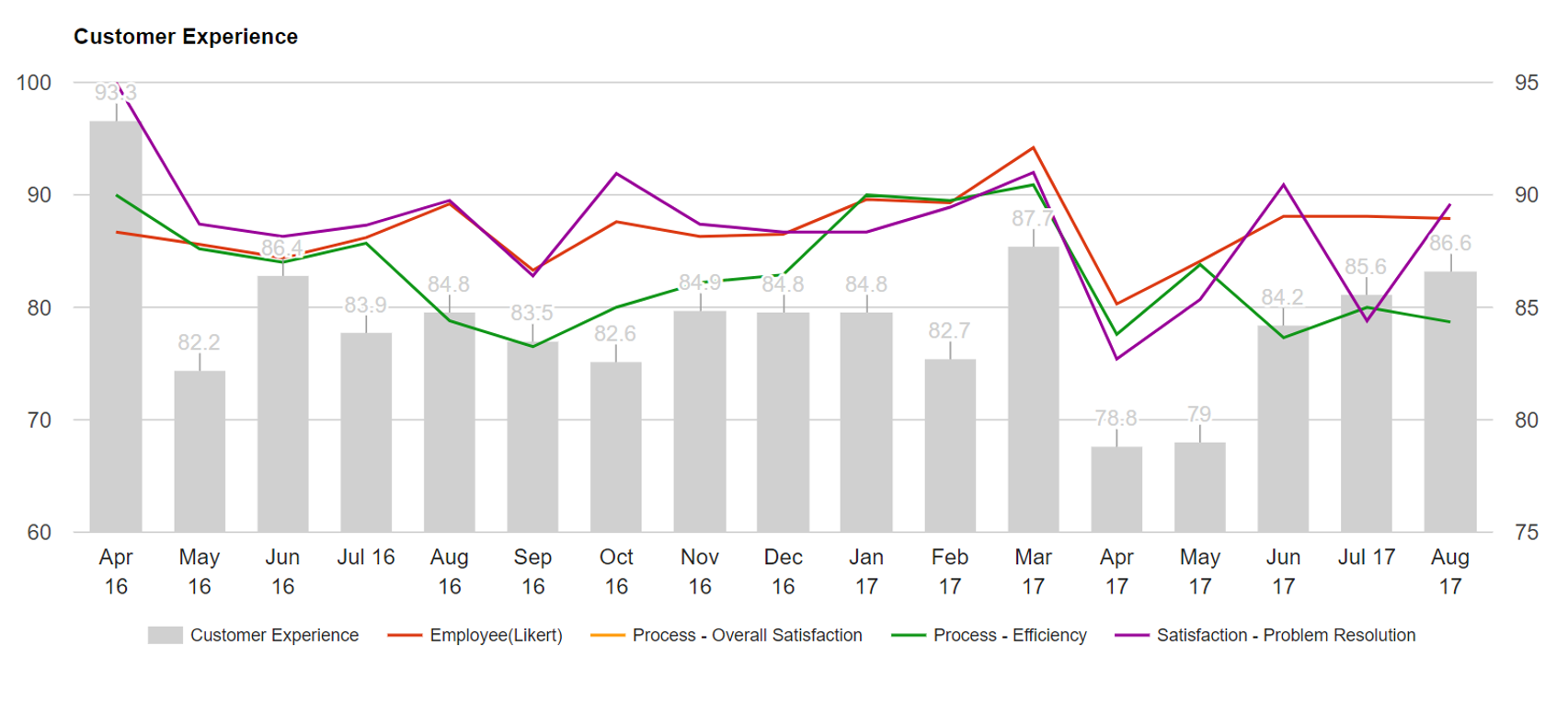

Customer Experience - Visualization

Reporting, analysis and visualization solutions for customer satisfaction research.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2025 www.ashokcharan.com. All Rights Reserved.