Customer value is the worth

in monetary terms of the economic, technical, service and social benefits a

customer firm receives in exchange for the price it pays for a market offering

(Anderson et al., 1993).

It follows that if Value > Price there

is incentive to purchase. An offering, however, is rarely considered in

isolation. Considerations of value take place within the context of one or more

competing products. If the incentive to purchase a product A (ValueA

− PriceA) is greater than the incentive to purchase competitor

product B (ValueB − PriceB), in that case the

buyer is likely to prefer A over B. The difference in the

incentive to purchase A over its competitor B is termed as Value

in Use (VIU).

$$ VIU_{A\,versus\,B}=(Value_A - Value_B ) - (Price_A - Price _B)$$

VIU analysis determines the monetary benefits of a

company’s offering, compared to its direct competitors. It allows companies to

articulate the true, differentiated value of their offering to their customers.

VIU analysis starts with an in-depth understanding

of customers, and the products and services offered by the company and its

competitors. A value assessment of costs and benefits in monetary terms is

required. Depending on the objective, this exercise may be quite detailed and

complex. The relatively simple example that follows serves as an illustration

of the approach.

Example — VIU analysis

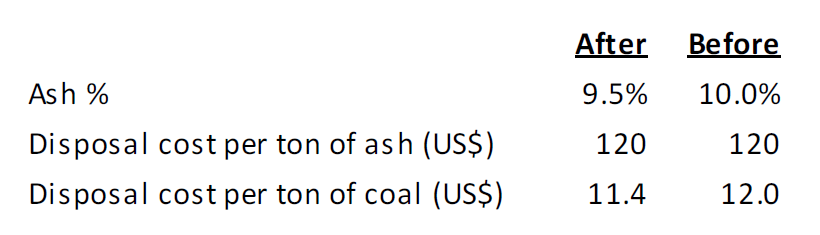

The ash level of coal at a

mine has declined from 10% to 9.5%. Assuming other specifications including

price remain the same, customers stand to benefit from savings in ash disposal

fees, which are estimated to be US$120 per ton.

$$ VIU_{A\,versus\,B}=(Value_A - Value_B ) - (Price_A - Price _B)$$

Since the price has not changed, VIUA versus

B becomes the incremental saving in value, and is equal to 60 cents

per ton. On an annual basis a customer consuming a million tons of coal will

save US$ 600,000 in ash disposal costs. This improvement in quality, which

translates to an increase in value from savings in the ash disposal costs,

provides a valid basis for price adjustment. Considering that the savings are

fairly significant, the mining company would be interested to know how much

increase in price may be justified, on account of the reduced ash content.

VIU Price

VIU Price is the monetary amount at which a customer has no preference between one offering

and an alternative offering (VIU = 0). Assuming that the supplier wants to

split the benefit of lower ash costs with customers, VIU price will serve as

the upper bound for the price adjustment.

$$ VIU_{A\,versus\,B}=0=(Value_A - Value_B ) - (Price_A - Price _B),$$

$$ VIU\,Price_A= Price_B+(Value_A - Value_B)$$

If the export price of coal is US$100 per ton, the VIU

Price for the improved coal is $100 + 60 cents = $100.60 per ton. Based on

the improved performance, the mining company can increase the price by as much

as 60 cents per ton.